Articles

Understanding your Credit Score has never been easier!

Your credit score is more than just a score – it’s the key to taking charge of your financial well-being, so that you can achieve your goals, be it a new car purchase, new home, or getting a person

Read moreWill a Fresh Start Increase My Credit Score?

It’s never too late to improve your credit score, and the start of a new financial year is a perfect time to begin.

Read moreWhy Did My Credit Score Go Down?

Keeping a watch on your credit profile can help you understand and address the reasons behind a drop in your score.

Read moreHow to Get a Loan

The first step in figuring out how to get a loan is determining your credit score. It is the main metric lenders consider when evaluating your credit...

Read moreHow The Election Results May Impact Your Finances

The Australian Labor Party (ALP) has won the federal election and Anthony Albanese will be Australia’s 31st Prime Minister.

Read moreHow to Get a Secured Loan with Bad Credit

Even with a below-average credit score, you can still get competitive rates on loans - read on to find out more!

Read moreHow to Get a Loan with Bad Credit

If you are among those who are wondering how to get a loan with bad credit, there are actually numerous options available to you; the key is knowing where...

Read moreHow to Check Your Credit Score

If you are wondering how to check credit score without hurting your rating, we have the solution!

Read moreWhat is a Credit History Check?

A credit history check provides a snapshot of your financial standing to help you make adjustments and improve your credit rating. You may think you have a...

Read moreHow to Maximise Your Disposable Income

Here are 5 ways to beat the cost of living crunch!

Read more5 Ways to Stay Motivated Towards Your Financial Goals

Keep your money goals on track this year.

Read moreWhat Is The Purpose Of a Credit Report?

What Is The Purpose Of a Credit Report? We've all heard of a credit report, but what does it mean and why is it important?

Read moreJust In: RBA to Hold Interest Rates at 0.10%

There has been significant growth in the Australian housing market due to COVID-19 and record low interest rates.

Read moreWhat Does a Credit Report Include?

Instant Credit Report Australia

Taking control of your finances begins with getting your instant credit report Australia.

Read more4 Money Questions You Need To Ask Your Partner in 2022

Love and Money

Finances can cause tensions in relationships but talking can help.

Read moreHow Does Bad Credit Affect Your Car Loan?

If you are in the market for a new car but have a poor credit rating, many credit providers would consider you a high-risk borrower.

Read more2022 Federal Budget Breakdown

How the new Federal Budget will affect your budget. READ MORE.

Read moreManage your credit & protect your identity

Equifax offers comprehensive credit monitoring and identity protection services. Sign up today to get protected.

Read moreHow to Get a Home Loan

If you dream of owning a house but lack the finances to make it a reality, learning how to get a home loan is an excellent starting point.

Read moreHow to Get a Credit Card

If you want greater control over your finances, learning how to get a credit card is an excellent starting point.

Read moreHow to Get a Car Loan

If you are interested in financing a new vehicle, you should have a good foundation of how to get a car loan.

Read moreThe most frequently asked questions around closing credit accounts, answered!

Closing credit accounts may help or hurt your credit score. Learn more about how to manage this change when you need to make it.

Read moreHow to improve your credit score: Useful tips to help increase your chances of loan approval and get better interest rates

Your credit score is good, but could it be better? Check out these simple tips for credit score improvement.

Read moreHow to pay off your debt and save

The right plan to pay off debt and save money can significantly improve your credit score! Learn about some steps you can take to deal with debt and savings...

Read moreMyths debunked: Clearing a default on your credit history

Clearing a default on your credit history means putting in a little time and effort, but the results can be spectacular.

Read moreGetting to know your credit score (and 6 practical tips to boost it!)

You really do have the power to understand and improve your credit score.

Read moreHow to improve credit score

Your credit score is good, but could it be better? Check out these simple tips for credit score improvement.

Read moreCredit Score Myths

With so much information available online, it can be tough to separate fact from fiction. To help you cut through the noise, we’ve busted the eight biggest...

Read more6 ways to maintain a good credit score

Here's how to maintain a good credit score

Read moreKeep up the good work: Monitor and secure your credit score

You’ve committed to improving your credit score, and now you’re enjoying the fruits of your labour. Learn how to keep your credit score in tip-top shape....

Read moreAre you on top of your finances?

Take part in our short interactive quiz to find out how good you are with money matters. Are you a spender, saver or somewhere in between? Find out now!

Read moreWhat are the benefits of improving your credit score?

Your credit score can have a major influence on approval for credit products like loans and credit cards, as well as the terms and conditions attached to...

Read moreHow to use your credit score and credit report to prevent identity fraud (3 key steps)

Your credit score and credit report can play pivotal roles in helping you recognise and prevent identity fraud. Learn more about keeping your identity safe...

Read moreHow a strong credit score supports your investment property plans

A strong credit score is a valuable asset when purchasing an investment property. Learn how to leverage your score in pursuit of this goal.

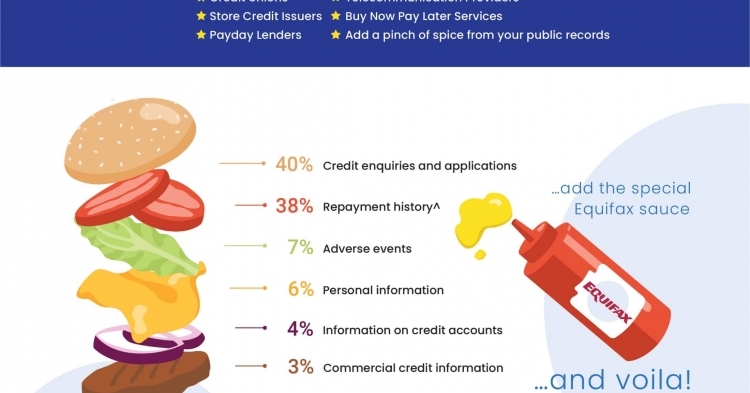

Read moreWhat makes up a credit score?

Your credit score is based on personal and financial information that's kept in your credit report.

Read moreCredit Score Infographic - how is your credit score calculated?

Have you ever wondered to yourself what actually makes up your credit score? Or how is my credit score calculated? Well wonder no more, as we serve to you...

Read moreHow your credit score can impact big-ticket items

Working on a big financial goal? Check our tips, including what you need to know about your credit score so it doesn’t hold you back.

Read moreYour Financial Safety Net Checklist

During such times of uncertainty, you can feel anxious about your financial future.

Find out what help you are eligible for

Read moreHow to pay off debt and save

The right plan to pay off debt and save money can significantly improve your credit score! Learn about some steps you can take to deal with debt and savings...

Read moreHere’s Why Your Credit Score Matters

Your credit score can have a big impact when you’re applying for new accounts or loans.

Read moreComprehensive Credit Reporting (CCR): What is it and why should you care?

Comprehensive Credit Reporting (CCR). What is it and why should you care?

Read more5 Ways to Start 2022 on a Stronger Financial Footing

Your fresh financial start to 2022

The last two years have been an interesting time.

Read more6 Ways to Get Your Finances on Track for 2022

Got new year get-things-done energy? Use it to fast-track your finances.

Read more

Spending, Shopping and Saving Post Lockdown

Lockdowns left many Australians with little choice but to save on things such as eating out, commuting to work, and holidays away.

Read moreHere's Your 2022 Financial Plan

Start the new year off right with a financial plan

Here’s how to get on top of your finances in 2022, discover smart strategies today.

Read moreHow to Avoid a 2022 Credit Hangover

Ho, ho, ho. ‘Tis the season to spend, but it doesn’t have to harm your credit health.

Read moreTrends in the Credit Market

According to Equifax’s Quarterly Consumer credit demand* index for September, consumer credit demand has continued its upward trajectory, with early...

Read moreBuy Now Pay Later Services and Your Credit

Buy Now Pay Later (BNPL) services, such as AfterPay, ZipPay and Openpay, which allow users to buy goods and take them home or have them delivered...

Read moreStay, switch or get a better deal from your bank or lender?

The COVID-19 pandemic has rapidly accelerated digital banking trends that were already on the rise.

Read moreKey Contributing Factors to Your Credit Score

Understanding your Credit Score has never been easier with Key Contributing Factors now displayed together with your all-important score through...

Read moreMoney Management During Challenging Times

Just when many of us hoped that the worst of the COVID-19 crisis may be behind us, with a seemingly fast rebounding economy, Australia has been hit with...

Read moreHow do monthly repayments affect my credit file?

The new comprehensive credit reporting (CCR) system may be beneficial to you as it can record 'good credit behaviour' on your credit report, like making...

Read moreCould your partner’s financial behaviours be impacting your future?

What do you look for in a partner? A kind heart? A good sense of humour? Good financial habits?

Read moreThe secret number the banks don’t want you to know

There’s a number out there that summarises your entire financial history – the good, the bad and the ugly.

Read moreGeneration buY; why not all hope is lost for us

It has never been harder to buy your first home¹.

Read moreAre you dating a credit dud?

Talking about money is a lot like being stuck on table 19 at your partner’s cousin’s wedding. Or, to put it simply, it’s uncomfortable at best.

Read more9 in 10 Australians want more competition in lending

9 in 10 Australians want more competition in lending, yet only 15 per cent know about the credit reform driving change.

Read moreCredit Score Myths

With so much information available online, it can be tough to separate fact from fiction.

Read moreHow To Improve Your Credit Score

Want To Know How To Improve Your Credit Score?

Read moreFinancial #Fitspo: Get Your Financial Scorecard Moving This Summer

Written by Miss Money Box, author of an educational blog to help Australian women expand their general knowledge around personal finance.

Six steps to ‘adulting’ with money

Written by Ben Nash, financial adviser and the founder of Pivot Wealth, a money management c

Read moreFree Credit Score | Discover Yours Now

Did you know its super simple to find out your credit score?

Read moreHow to get ‘credit score fit’ in 2018

Written by Ben Nash, financial adviser and the founder of Pivot Wealth, a money management compa

Read moreTop 5 tips on car insurance - a MUST read

1. Get the right insurance for your needs and situation

Read moreEverything To Know About Comprehensive Credit Reporting

Positive (Comprehensive) Credit Reporting (CCR) will be mandated by the Australian government from the 1st July 2018, giving lenders access to a deeper,...

Read moreImpact Of Comprehensive Credit Reporting - Credit Score Averages

Equifax has released their findings on the

Read moreHow to pay off debt faster

Written by Ben Nash, financial adviser and founder of Pivot Wealth,

Read moreDoes your Credit Score vary among providers?

Your credit score may vary from one credit provider to another. Here’s why.

Read morePositive vs Negative Credit Behaviours

Last month we updated you on the latest changes to Comprehensive

Read moreTake charge of your financial wellbeing

Knowing what’s in your credit report and what it’s used for is a key measure of your financial health.

Read moreWhat’s Your Credit Attitude?

When the COVID-19 pandemic first hit Australia in 2020 it caused a lot of consumers to reassess their financial situation, review their spending, and...

Read more3 Reasons to Get a Loan Via a Broker

Paid Advertisement from MacCredit*

Get help with your personal loan requirements.

Read moreWhat is a comparison rate and why is it important?

Paid Advertisement from NOW Finance*

What information do you look for when searching for a personal loan?

Read moreWhy Your Credit Score Matters

Your credit score is the key to your financial future.

Read moreWhat Lenders Know About Your Credit History

When you apply for a line of credit, be it a home loan, a personal loan, a credit card or a new mobile phone plan, lenders will check out your credit report...

Read moreHow can I Improve my Credit Score?

Having a good credit score is always a key part of your financial well-being.

Read moreHave a ‘Credit Smart’ Happy Holiday

One thing is for sure, these holidays are likely to be like none other we’ve experienced. Yet we all need joy now more than ever.

Read moreStatus update on Financial and Credit Market

A year of unprecedented changes to our lives and livelihoods have required the Government to make many rapid changes to support consumers and the economy....

Read moreCOVID-19 and the Property Market

Like so much else in our lives, COVID-19 has upended the Australian property market, from how auctions and inspections are held to lower stock levels and a...

Read moreHow to Save on Utilities

The COVID-19 pandemic has led to unprecedented tough times, leaving many of us feeling more frugal.

Read moreWhat to Do if You’re Struggling to Pay Your Mortgage

With rising unemployment and many businesses forced to shut at least temporarily, many Australians are suddenly wondering how they’ll continue to meet their...

Read moreUnderstanding Your Credit Score

Let us guide you through what you should know about your credit score, so you can find out where you stand!

COVID-19 and Your Taxes

The COVID-19 pandemic has impacted many things already this year and the next on the list may be your taxes.

Read morePrioritising Your Bills When Money is Tight

When your finances are stretched, paying all of your bills in full on time each month can become near impossible.

Read moreCOVID-19 and Your Credit

The COVID-19 pandemic has upended much about our daily lives.

Read moreHow refinancing your home loan could help you get on top of personal debt

An article from uno Home Loans

Read moreWomen likely to be better with finances than men?

It is hard to deny the fact that the female species is a safer financial bet.

Read moreWhat COVID financial assistance is available to you now?

With Covid-19 rapidly up-ending the way we live and work, the financial aspects can be as concerning as the potential health risks.

Read moreBenefits of Comprehensive Credit Reporting (CCR)

With Comprehensive Credit Reporting (CCR) now fully implemented, you have the power to turn any skeletons in your financial closet to dust.

Read more5 Ways to Care for Your Credit Health

Taking care of your credit is a critical part of maintaining your financial wellness.

Read more